Understanding property management fees is crucial for any real estate investor or landlord. Whether you own a single-family home, a multi-unit building, or a sprawling commercial property, effectively managing your investment requires a clear comprehension of the costs involved. This article delves into the complexities of property management fees, outlining the various types of fees you can expect, what services they cover, and how to ensure you’re receiving value for your money. By understanding these fees, you can make informed decisions about your investment and maximize your return.

Navigating the world of property management can be challenging, especially when it comes to understanding the financial aspects. This comprehensive guide will break down the different property management fee structures, including percentage-based fees, flat fees, and tiered pricing models. We’ll also discuss what factors influence these fees, such as property type, location, and the scope of services provided. By gaining a thorough understanding of property management fees, you can effectively budget, negotiate favorable terms, and ultimately optimize your real estate investment strategy.

What Property Managers Do

Property managers handle the day-to-day operations of rental properties on behalf of the owners. Their responsibilities are multifaceted and designed to maximize the owner’s return on investment while maintaining the property’s value.

Key responsibilities often include:

- Marketing and Tenant Acquisition: This involves advertising vacancies, screening potential tenants, and managing the lease signing process.

- Rent Collection and Financial Management: Property managers collect rent, handle late payments, and provide financial reports to owners.

- Property Maintenance and Repairs: They oversee routine maintenance and coordinate necessary repairs, often contracting with vendors for services.

- Tenant Communication and Management: Addressing tenant concerns, enforcing lease terms, and managing move-outs are crucial aspects of this role.

- Legal Compliance: Staying abreast of and adhering to fair housing laws and other relevant regulations is essential.

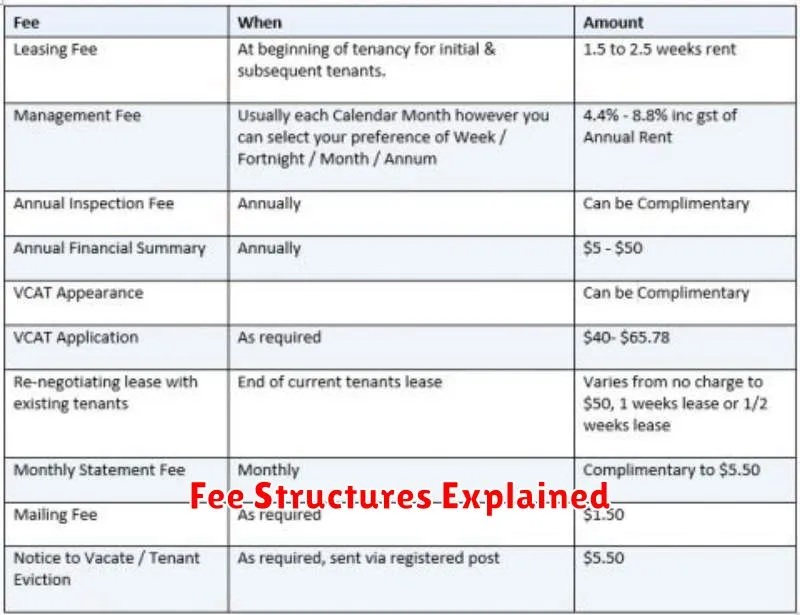

Fee Structures Explained

Understanding how property management fees are structured is crucial for both property owners and tenants. There are several common fee structures employed by property managers.

Percentage-Based Fees

This is the most prevalent structure. The property manager charges a percentage of the monthly rent collected. This percentage typically ranges from 4% to 12%, depending on factors such as the property’s size, location, and the services provided. A higher percentage often corresponds to more comprehensive management.

Flat-Rate Fees

A flat monthly fee is a less common option, generally used for smaller properties or those with consistent rental income. This structure provides predictability for budgeting purposes, but may not be as cost-effective for higher-rent properties.

Hybrid Fees

Some property managers use a hybrid approach, combining a percentage-based fee with a flat fee for specific services. For example, they might charge a percentage of the rent collected plus a fixed fee for advertising or lease renewals. It’s important to clearly understand all components of a hybrid fee structure.

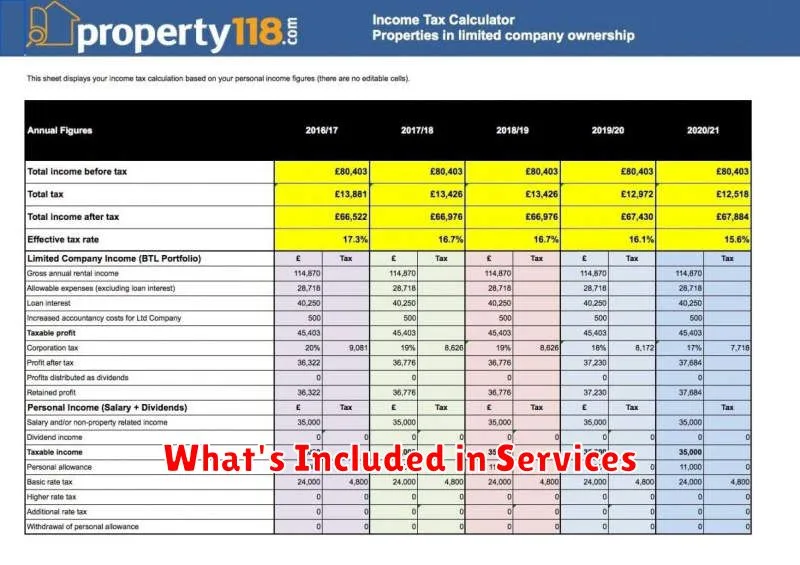

What’s Included in Services

Property management fees cover a range of services designed to protect your investment and maximize returns. Understanding what these services entail is crucial for evaluating value.

Core services typically include tenant screening and placement, involving background and credit checks, lease preparation and execution. Rent collection and financial reporting are also standard, providing detailed accounting of income and expenses. Maintenance and repair coordination is another key element, encompassing handling tenant requests and overseeing necessary repairs.

Beyond these core services, some property managers offer additional services such as marketing and advertising vacant units, handling property inspections, and even providing legal guidance related to landlord-tenant laws. The specific services offered can vary depending on the management company and the type of property.

Negotiating Management Costs

Negotiating property management fees is a standard practice. Don’t hesitate to discuss costs with potential managers. A clear understanding of services offered and their associated costs is crucial for both parties.

Several factors influence the final fee. The size and type of your property play a significant role. Larger properties or those requiring more intensive management might command higher fees. The location of the property also matters, as management costs can vary by market.

When negotiating, be prepared to discuss the scope of services. Are you looking for a full-service manager or someone to handle specific tasks? Clearly defining your needs upfront can impact the cost. Consider the market rates in your area. Researching average fees for similar properties can help you determine a reasonable negotiation range.

When It’s Worth It

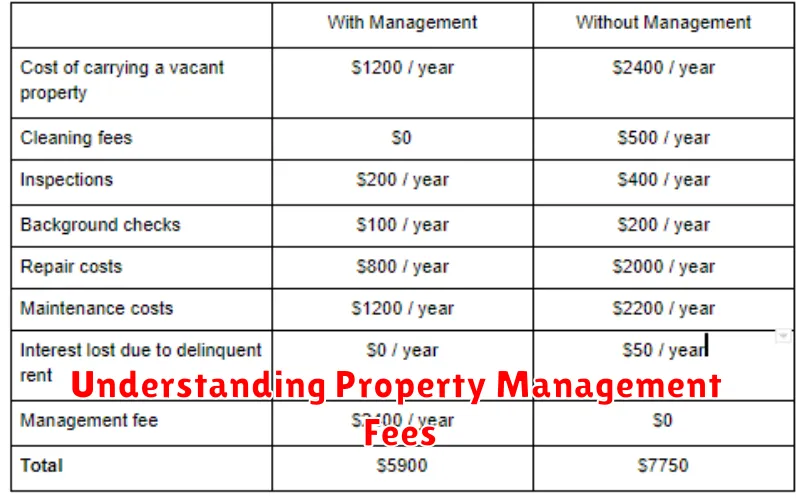

Hiring a property manager involves a financial investment. Therefore, it’s crucial to understand when the cost justifies the benefits. Weigh the time commitment, your comfort level with landlord responsibilities, and the size of your portfolio.

If you own multiple properties or lack the time for daily management tasks, the cost of a property manager can be a worthwhile expense. They handle tenant screening, rent collection, maintenance, and legal compliance, freeing up your time and potentially minimizing stress.

For owners living far from their rental properties, a property manager becomes almost essential. They act as your local representative, addressing issues promptly and ensuring smooth operations.

Hidden Costs to Watch

While the stated property management fees might seem straightforward, it’s crucial to be aware of potential hidden costs that can impact your overall expenses. These costs can vary depending on the management company and the specific terms of your contract. Diligent review and open communication are essential to avoid unexpected financial burdens.

Some common hidden costs include lease renewal fees charged to the owner for renewing a tenant’s lease. There may also be vacancy fees applied during periods when the property is unoccupied. Maintenance markups can occur when property managers add a percentage to the cost of repairs performed by third-party contractors. Administrative fees might encompass charges for tasks like processing paperwork or handling tenant communications.

Be sure to inquire about early termination fees should you decide to end your contract with the property management company before its expiration. Additionally, understand how reserve funds are handled. These funds, collected for future property maintenance, should be clearly accounted for and used appropriately.