Late rent fees can be a significant drain on your finances. Avoiding them is crucial for maintaining a healthy budget and a positive relationship with your landlord. This article will provide comprehensive guidance on how to avoid rental late fees, covering everything from understanding your lease agreement to setting up automatic payments and communicating effectively with your landlord. Learn how to prevent those unnecessary late fees and keep your hard-earned money in your pocket where it belongs. Whether you are a seasoned renter or just starting out, the strategies discussed here will empower you to stay on top of your rent and avoid the financial penalties of late payment.

From understanding grace periods and leveraging technology to implementing practical tips and exploring potential negotiation tactics, this guide will offer a range of solutions to help you navigate the complexities of rent payment and avoid late fees. By proactively addressing the issue of potential late payments, you can protect your credit score, preserve your financial well-being, and foster a strong tenant-landlord relationship. Don’t let late fees add unnecessary stress to your life; learn how to avoid them effectively and enjoy the peace of mind that comes with timely rent payments.

Understand Your Due Dates

One of the most critical aspects of avoiding late fees is a thorough understanding of your due dates. Your lease agreement should clearly stipulate the day of the month your rent is due. Mark this date on your calendar, set reminders on your phone, or use a dedicated rent payment app. Don’t rely solely on memory.

Grace periods, if any, should also be detailed in your lease. While a grace period offers a short window after the due date to pay without penalty, it’s best practice to pay on or before the official due date to avoid any potential complications.

Understand the consequences of late payment. Your lease will specify the late fee amount and how it accrues. Some leases impose a flat fee, while others calculate a percentage of the overdue rent. Knowing these details reinforces the importance of timely payments.

Use Auto-Pay or Reminders

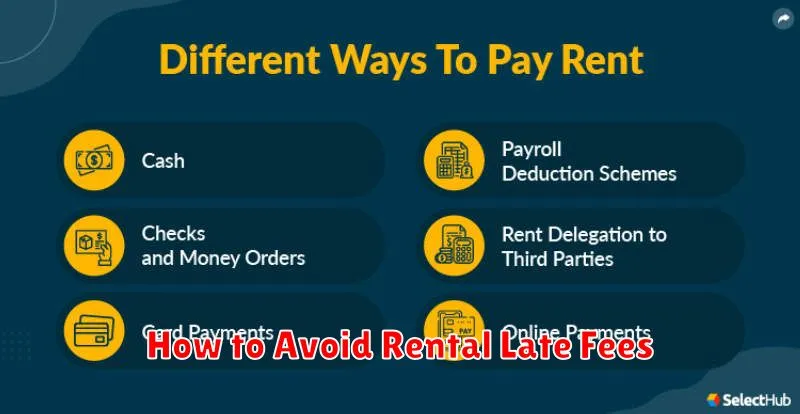

One of the easiest ways to avoid late fees is to set up automatic payments. Most property management companies and landlords offer online portals where you can link your bank account or credit card to automatically deduct the rent each month. This eliminates the risk of forgetting the due date entirely.

If you prefer to maintain more control over your payments, set up reminders. Use your phone’s calendar, a dedicated reminder app, or even a simple sticky note to alert you several days before the rent is due. This gives you ample time to make the payment before incurring any late fees.

Consider multiple reminders, particularly if you’ve struggled with timely payments in the past. An initial reminder a week before the due date, followed by a second reminder a day or two before, can be extremely effective.

Talk to Landlord Early

One of the most effective ways to avoid late fees is proactive communication with your landlord. As soon as you realize you might miss a payment deadline, reach out to them. Explain your situation honestly and clearly.

Early communication demonstrates responsibility and a willingness to work with your landlord. It opens the door for potential solutions. Landlords are often more understanding and flexible when tenants are upfront about their challenges.

Don’t wait until after the due date to initiate contact. The longer you wait, the less likely it is that your landlord will be willing to waive or reduce late fees. Your landlord may be more inclined to work with you if you’ve established a positive payment history.

During the conversation, propose a payment plan if possible. This shows your commitment to fulfilling your financial obligations. Even if they can’t waive the fee entirely, they may be open to a smaller fee or a revised payment schedule.

Avoid Bounced Payments

A bounced payment, also known as a non-sufficient funds (NSF) payment, occurs when there isn’t enough money in your account to cover a transaction. This can lead to returned check fees from your bank and late fees from your landlord. Additionally, multiple bounced payments can damage your relationship with your landlord and potentially affect your credit score.

To avoid bounced payments, it’s crucial to maintain sufficient funds in your account. Regularly check your balance, ideally a few days before your rent is due. Set up low-balance alerts to provide early warning if your funds are running low. If you anticipate a potential shortfall, contact your landlord before the due date to discuss possible arrangements.

Negotiate Grace Periods

One of the most effective ways to avoid late fees is to negotiate a grace period with your landlord. A grace period is a set number of days after the rent due date during which you can pay rent without incurring a late fee.

Before signing your lease, inquire about the possibility of a grace period. Some landlords may already have a grace period built into their lease agreements. If not, be prepared to clearly articulate your request and explain why a grace period would be beneficial for you. For example, you might explain that your paycheck is deposited a few days after the rent due date.

While negotiating, be respectful and professional. Understand that your landlord is not obligated to grant a grace period. If your landlord agrees, ensure the terms of the grace period, including the number of days and any applicable conditions, are clearly documented within the lease to avoid any future misunderstandings.

Track All Transactions

Maintaining meticulous records of all rental-related transactions is crucial for avoiding late fees. This includes not only rent payments, but also any other associated costs such as late fee waivers, maintenance charges, or security deposit returns.

A simple spreadsheet can be highly effective. Track the date, amount, payment method (e.g., check, online transfer, money order), and confirmation number for each transaction. This provides a readily available reference in case of discrepancies or disputes.

Consider setting up email or text alerts for upcoming rent due dates. Many property management platforms and banking apps offer this functionality. These reminders can help you avoid late payments altogether.